39+ How much will i get approved for a loan

Includes mortgage default insurance premium of 669302. A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

Heritage 3039r 39 Hp Tractor Package Special

Some mortgage lenders will charge a non-refundable fee for their pre-approval services.

. And if youre ready to start applying for a loan Koyo offers flexible personal loans of 1500-12000. Checking Your Credit History. Thats a big range we know so if we had to set a rule it.

That means if you. This mortgage pre-approval calculator gives you the opportunity to know in advance how much home financing you can. FHA loans have certain restrictions on the amount a single person can borrow.

They collect this fee when you submit your application paperwork. How the mortgage pre-approval calculator works. Every bank has set minimum income eligibility for getting a car loan and it varies from bank to bank.

1 Select a Credit Profile. The loan limit for an. You can usually get a feel for whether youre mortgage-eligible by looking at your own personal finances.

The industry standard is 36 though this does vary significantly depending on your circumstances and location. In general most loans offer between 1000 and 100000. You may qualify for a loan amount of 252720 and your total monthly mortgage.

You can calculate this simply by gross income x 036 12. If your credit score is shaky the time to take action is. Using the guideline that your home-related expensesshouldnt be more than 28 of your gross income you should try to keep your monthly mortgage payment including property taxes and.

Estimate how much you can get approved for based on income debt and credit factors. Based on the calculator output for our example you would likely be approved for a home up to 423495. If you have any questions let us know in the comments section below.

It usually is 06 to 065 in most cases. However higher your salary is. Youll have the best chances at mortgage approval if.

A total mortgage amount of. Even though a lender might approve you for a high mortgage amount. Here are some ideas you might want to consider when applying for a personal loan.

You can spend between 10 and 50 of your gross annual income on a car. Most people who get approved for a personal loan can borrow anywhere between 1000 to 50000 at a time depending on factors such as their credit score and existing debt. The latest research shows new borrowers have taken out an average of 7000 in personal loans.

For the purposes of this tool the default insurance premium figure is. These specific requirements must be met to qualify for the pre-approval. Were not including any expenses in estimating the income you.

Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Probably not as much as you might think.

Application Examples 39 In Pdf Examples

Offer Letter Examples 39 In Ms Word Pages Google Docs Outlook Pdf Examples

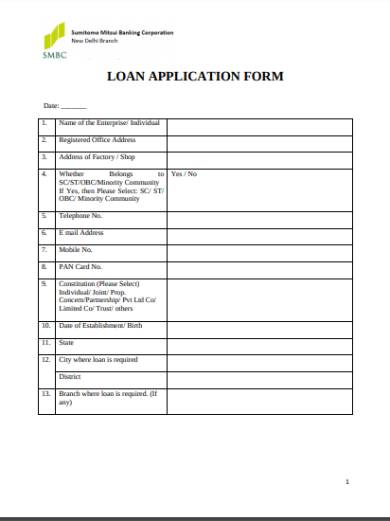

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Offer Letter Examples 39 In Ms Word Pages Google Docs Outlook Pdf Examples

Annual Report Neighbors United Fcu

Wallpapers Molang Officiel Website Page 2 Noel Hinh Nền Anime

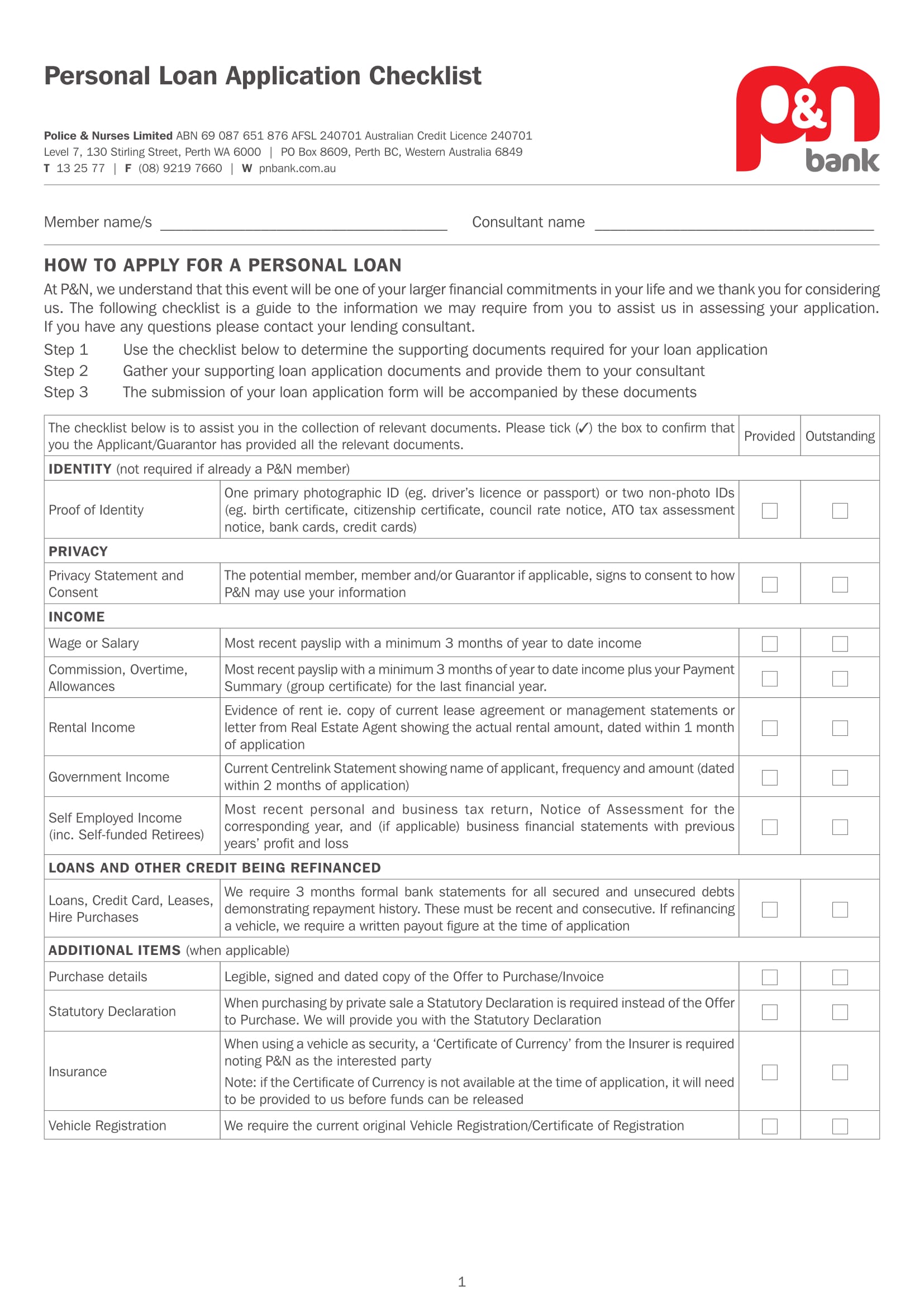

Free 3 Bank Loan Application Form And Checklist Forms In Pdf

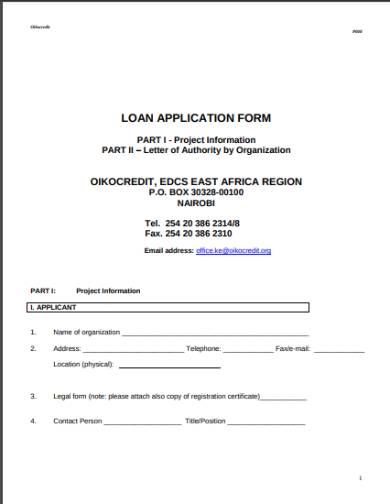

Loan Proposal 11 Examples Format Pdf Examples

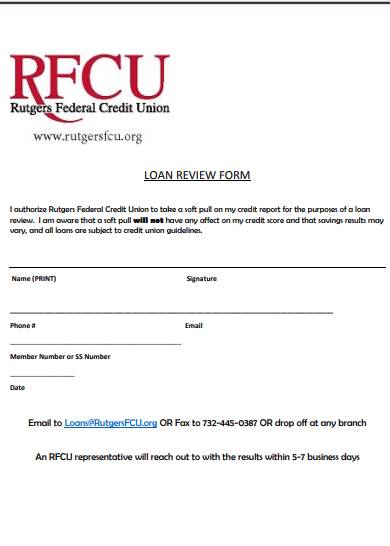

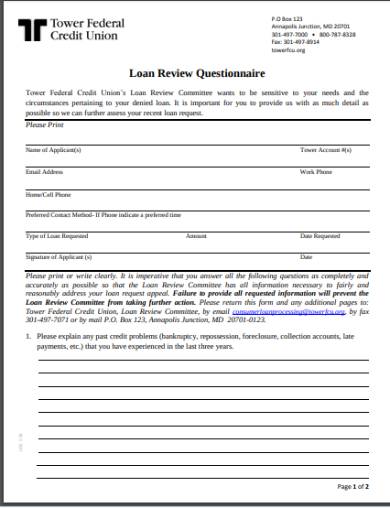

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Idbi Bank Offers Car Loans With Attractive Interest Rates For Upto 7 Years Calculate Your Eligibility And Get A Free Emi Quote Car Loans Car Finance Finance

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Loan Proposal 11 Examples Format Pdf Examples

32 Acknowledgement Letter Templates Free Samples Examples Format Download Free Premium Templates Letter Templates Free Letter Templates Resume

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Offer Letter Examples 39 In Ms Word Pages Google Docs Outlook Pdf Examples

Pin On School Stuff